- Popular Fintech

- Posts

- On PayPal's strategic priorities and getting back to growth

On PayPal's strategic priorities and getting back to growth

PayPal might not have shocked anyone with their Innovation Day, but everything they launched was aligned with their strategic priorities. These priorities lay out the path to growth.

Hello!

The topic of today’s newsletter is PayPal. I must admit that it is the most confusing Fintech stock for me and I’ve struggled to formulate my thesis. It is easy to follow the bearish path (competition with Apple Pay, poor Braintree margins, etc.). However, I am not ready to give up on them. After all, PayPal has a huge customer base (393 million consumers and 35 million merchants), which will take years and billions in marketing spend for any competitor to replicate.

In addition to me struggling to formulate my thesis, I wouldn't say I liked the company’s previous CEO. He dodged all analysts’s questions, and, I believe, mentally left the building a long time ago. Needless to say, I was (still am) excited about Alex Chriss taking over the helm. I was even more excited to hear him lay out the company’s priorities during the Q3 2023 earnings call. Those were:

✔️ Reinvent consumer experience to drive a clear and durable value proposition,

✔️ Improve and scale PayPal Complete Payments for small businesses globally,

✔️ Drive margin expansion in Braintree and other products for large enterprises

My first reaction was “We’ve heard that before!”. However, the more I learn about the company, the more I realize that these priorities are spot on. As I will illustrate shortly, these priorities lay out the path to revenue growth acceleration, a non-negotiable feature of growth companies. I don’t know if Alex Chriss and the team will succeed in changing the trajectory of PayPal, but he certainly gave us a framework on how to think about the drivers of growth and how to spot a potential inflection point. Let's dive into this!

I’ll start with a brief intro to PayPal’s revenue. PayPal has multiple revenue streams, but the largest are: 1) fees charged to SME merchants for accepting payments via the PayPal button (“branded processing”), 2) fees charged to Enterprise merchants for accepting online payments with Braintree gateway (“unbranded processing”), and 3) interest earned on customer balances and outstanding loans.

In the income statement, “branded” and “unbranded” processing revenues are reported under “Transaction revenues”, while interest earned on customer balances and loans is reported under “Revenues from other value added services.” In Q3 2023, “Transaction revenues” contributed 89.7% of the total revenue, while “Revenues from other value added services” contributed the remaining 10.3%.

Transaction revenues: Net transaction fees charged to merchants and consumers on a transaction basis based on the TPV completed on our payments platform. Growth in TPV is directly impacted by the number of payment transactions that we enable on our payments platform.

Revenues from other value added services: Net revenues derived primarily from revenue earned through partnerships, referral fees, subscription fees, gateway fees, and other services we provide to our merchants and consumers. We also earn revenues from interest and fees earned on our portfolio of loans receivable and interest earned on certain assets underlying customer balances.

In Q3 2023, total net revenue increased 8.4% YoY, driven by 6.7% YoY growth in “Transaction revenue”, and 24.8% growth in “Revenues from other value added services”. However, the growth in Transaction revenues was driven by Braintree, while the revenue from the company’s core products (PayPal wallet and PayPal Checkout, which can be referred to as the PayPal button) declined.

Transaction revenues grew by $420 million, or 7%, and $1.1 billion, or 6%, in the three and nine months ended September 30, 2023, respectively, compared to the same periods of the prior year driven primarily by growth in TPV and the number of payment transactions from our Braintree products and services partially offset by a decline in revenues from our core PayPal products and services.

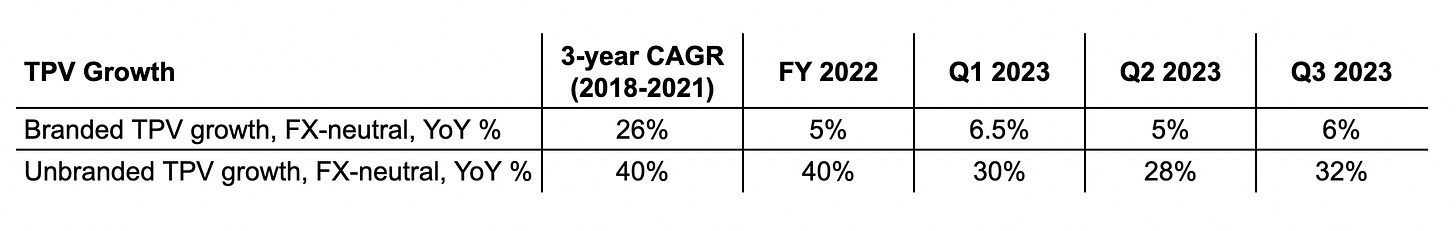

A widely circulating narrative is that PayPal is losing market share to Apple Pay and Shop Pay, and the declining revenue from “branded processing” (“core PayPal products”) is the best illustration of this trend. E-commerce volumes continue to grow, so declining revenue means that PayPal is simply losing market share to competitors.

This brings me to the first priority set by Alex Chriss: “Reinvent consumer experience to drive a clear and durable value proposition.” Essentially, the declining revenue from “branded processing” means that consumers prefer other payment methods over the PayPal wallet (Apple Pay, Shop Pay, etc.). So by improving the customer experience and enhancing the value proposition of the wallet, PayPal aims to restore growth in “branded processing.”

During its Innovation Day, PayPal released the first set of improvements to its offering. We can endlessly debate whether cashback and “smart receipts” count as innovation, but those were clearly targeted efforts to improve the value proposition of the wallet (and drive “branded processing” volumes). Cashback and rewards work in credit cards, why wouldn’t those work with PayPal wallet?

Before we get to the second priority, let’s look into the geographical split of PayPal’s revenue. As you can see from the table below, PayPal’s U.S. net revenue in Q3 2023 increased 7.01% YoY, while U.S. E-commerce sales increased 7.57% YoY. So even with a strong contribution from Braintree, PayPal is already growing slower than the U.S. e-commerce market. I would conclude that the U.S. market is where PayPal faces the fiercest competition.

At the same time, International revenue growth has been stable and even accelerated to double digits in Q3 2023 on both, nominal and FX-neutral, bases (see the table below). And don’t forget that Braintree has a much smaller footprint outside of the U.S. (and Venmo is a purely U.S. phenomenon). Thus, this is the PayPal button that delivered double-digit growth internationally.

In Q3 2023, the U.S. contributed 57.4% of total net revenue. No country outside of the U.S. contributed more than 10% of PayPal’s revenue, so PayPal typically does not provide a breakdown beyond “U.S.” and “International”. However, they did disclose that in Q3 2023, the company generated 20% of net revenue in the EU and 7% in the U.K. (combined, it’s 63% of the international revenue).

Moreover, 62% of gross loan receivables (loans) are due from customers in the U.K. and the EU. Thus, in the EU and the U.K. PayPal not only has a strong footprint with its checkout and wallet services, but also has strong lending capabilities. This brings me to the second priority set by Alex Chriss, “scale PayPal Complete Payments for small businesses globally.”

PayPal Complete is a new product, which combines the power of Braintree with the simplicity of PayPal Checkout. My read is that PayPal sees the opportunity in the SME sector outside of the U.S. (hence the use of the word “globally”), and, more specifically, in the markets, where they already have a strong track record (such as the U.K. and the EU).

Before we move on to the third priority, I would like to wrap up the discussion on revenue by spending some time on “Revenue from value added services.” “Revenue from value added services” grew (25% YoY in Q3 2023) because of the rising interest rates. PayPal earns interest on customer account balances, so the rising interest rates translated into the growth in revenue. I think it is unreasonable to expect the interest rates to go higher. Quite the opposite, if (or rather when) the central banks start cutting rates, this will be a headwind for PayPal.

Revenues from other value added services increased $152 million, or 25%, and $540 million, or 33%, in the three and nine months ended September 30, 2023, respectively, compared to the same periods in the prior year primarily attributable to increases in interest earned on certain assets underlying customer account balances resulting from higher interest rates, and to a lesser extent, interest and fee revenue on our loans receivable portfolio driven by consumer interestbearing installment loans and consumer revolving loans.

In addition, in the summer of 2023, PayPal entered into a multi-year partnership with KKR related to the sale of interest-bearing consumer loans. This includes the sale of the existing portfolio and future originations of “eligible loans”. While PayPal will retain the servicing rights and will earn a servicing fee, this will certainly make less than if they held these loans on their balance sheet. Another headwind for the value added services revenue.

In June 2023, we entered into a multi-year agreement with a global investment firm to sell up to €40 billion of U.K. and other European buy now, pay later loan receivables, consisting of eligible loans and interest receivable, held for sale at the closing of the transaction and a forward-flow arrangement for the sale of future originations of eligible loans. We will maintain the servicing rights and receive a servicing fee for the entire pool of the eligible consumer installment receivables outstanding.

The final priority, “Drive margin expansion in Braintree and other products for large enterprises”, comes from the simple fact that while Braintree has been a great driver of TPV and net revenue, it had a marginal contribution to gross profit due to extremely aggressive pricing. The chart below illustrates that growth in TPV has not translated to gross profit growth in the past two years.

Another way to illustrate the same point is by using the Transaction margin (PayPal’s name of gross profitability). As you can see from the chart below, the Transaction margin has been steadily declining, as the high-margin “branded processing” revenue was replaced by the low-margin “unbranded processing” revenue.

Increasing margins for “unbranded processing” might come from either increasing prices or upselling merchants to value-added services, such as fraud monitoring and prevention. The former is a faster route to improving margins, but will hurt competitiveness (read growth), so I’d expect PayPal to use a combination of both.

Here’s the recap of why, if executed well, the set strategic priorities will get PayPal back to growth:

✔️ Reinvent consumer experience to drive a clear and durable value proposition: Return to growth in “branded processing”, but providing incentives for consumers to use PayPal wallet at checkout.

✔️ Improve and scale PayPal Complete Payments for small businesses globally: Double down on the opportunities outside of the U.S., where PayPal has a strong footprint and faces lighter competition (such as the EU and the U.K.)

✔️ Drive margin expansion in Braintree and other products for large enterprises: reprice Braintree processing and expand the offering with value-added services to translate TPV growth into gross profit growth

Of course, there is more work to do to drive growth in earnings. The company has gone through a period of rapid growth, so there are certainly cost optimization opportunities. This can improve earnings in the short term, but it’s revenue growth that could change the narrative for the stock. PayPal needs to return to growth, and the laid-out priorities are a good start!

Thank you for reading and have a great day!

Jevgenijs

Cover image: PayPal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.